If you want a simple, long-term savings plan that you can’t dip in and out of then this is ideal for you.

- monthly premiums start at just £25

- you can save up to £300 a month

- your savings earn annual bonuses and normally a final bonus on encashment

- guaranteed lump sum after 10 years

- your first £25 a month savings can go into a Tax Exempt Plan

- Metfriendly does not pay tax on the income and capital gains made for the Tax Exempt Plan – so we can pay higher bonuses

- after 10 years, you can get the total value of your plan paid to you or leave it invested with Metfriendly to grow

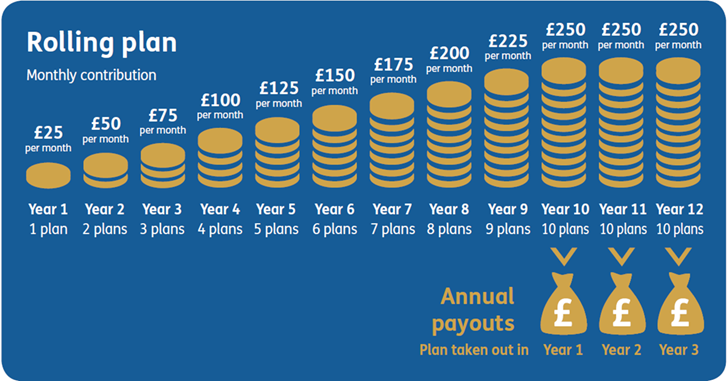

- ‘Rolling Plan’ option gives you a pay-out every year (after the first ten years)

NOTE: You can request the first £25 of your monthly premium to be tax-exempt if you are not paying into a tax-exempt plan elsewhere. The tax-exempt part of your savings will be issued as a separate contract.

Watch this video for a quick summary of our Ten Year Savings Plan.

Rolling Plan

Many of our members also choose to start new plans every year. This can be set up automatically and is known as the Rolling Ten Year Savings Plan and means that after ten years you will start receiving a pay-out every single year – ideal for regular annual events like Christmas, school fees or holidays. See “What is the Rolling Ten Year Savings Plan?” below for full details.